Why Use PayHUB?

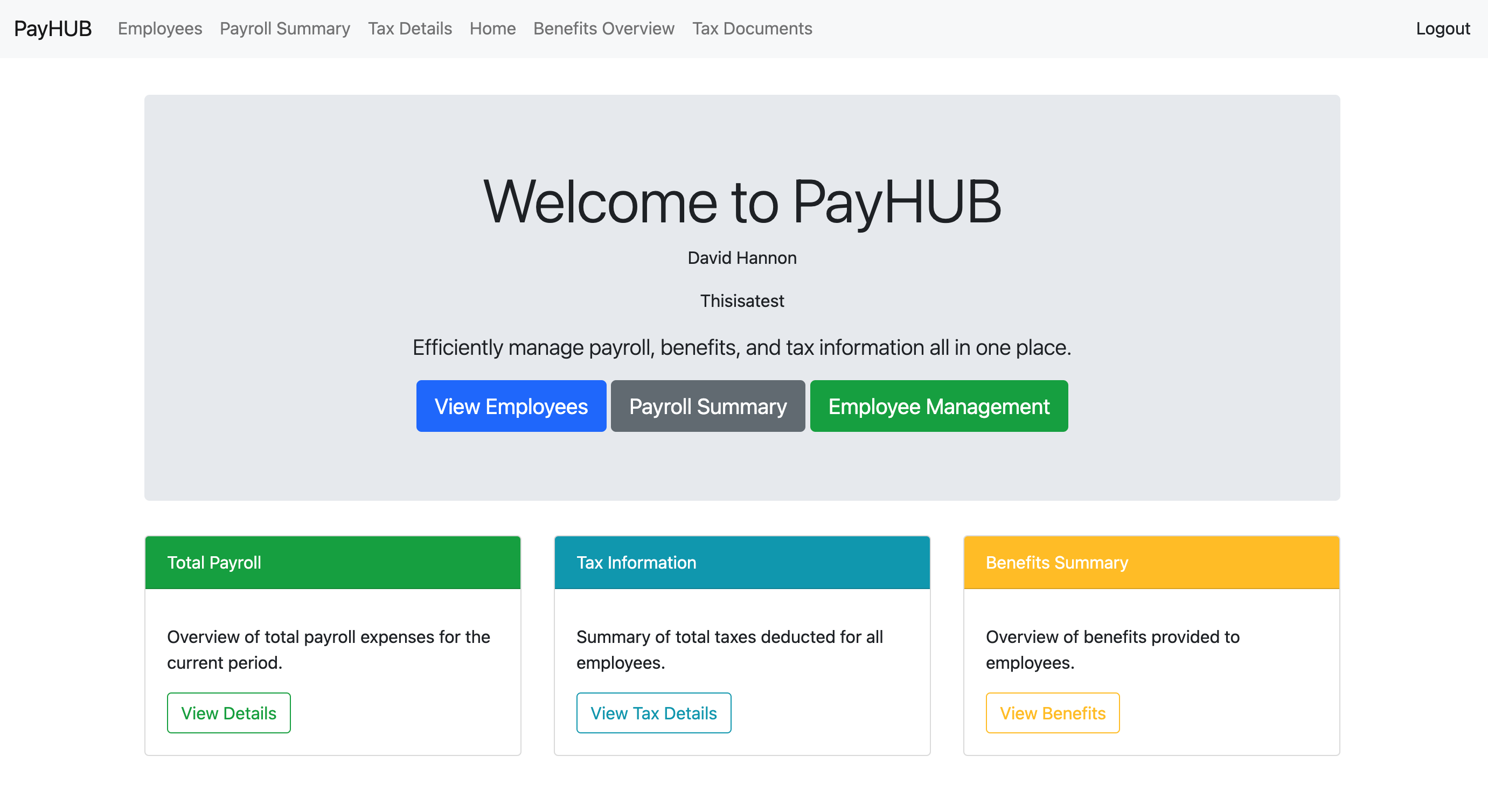

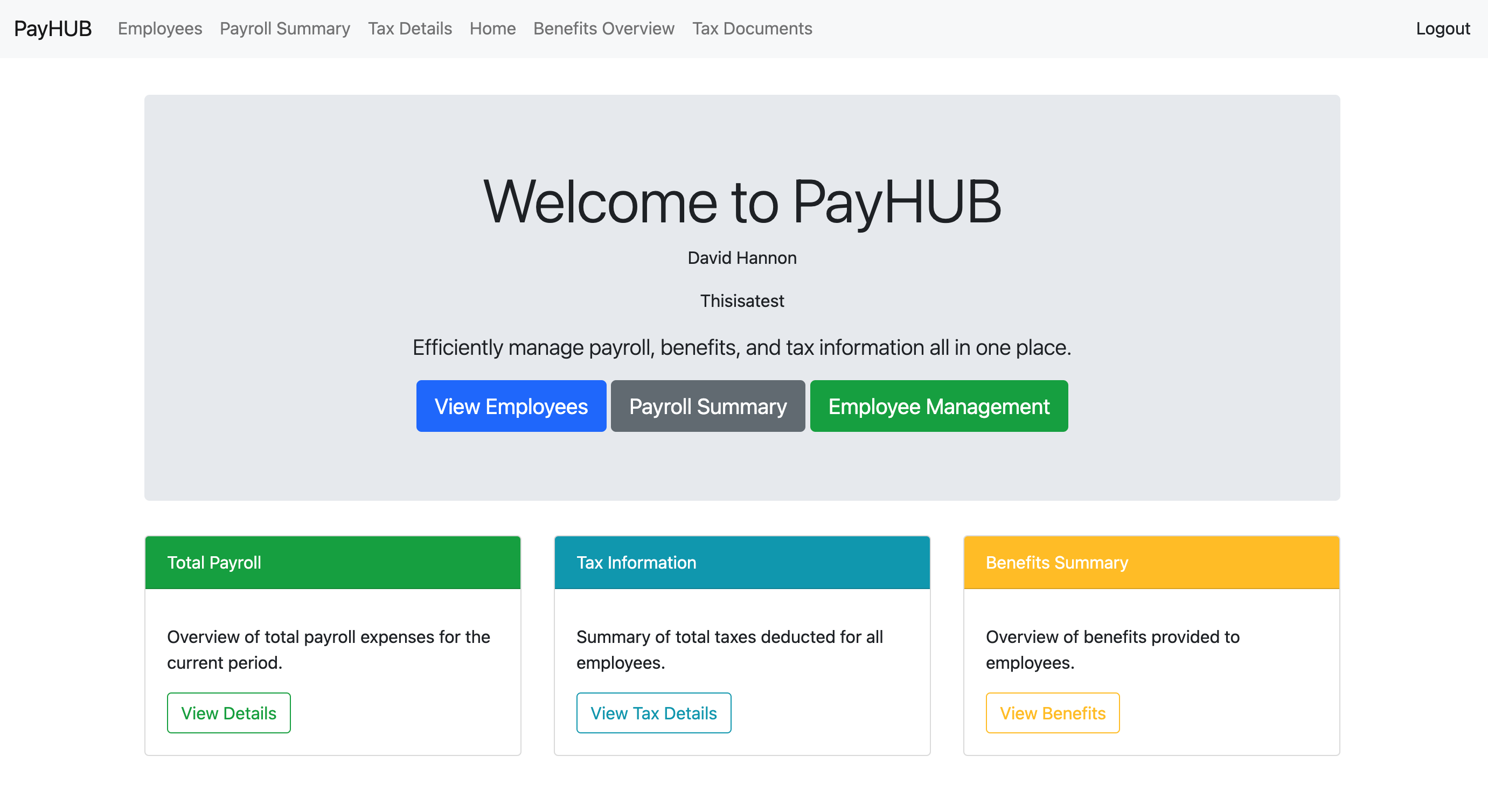

PayHUB is a comprehensive payroll management platform that empowers businesses to handle payroll, benefits, and taxes all in one centralized system.

- Payroll Processing: Calculate and distribute accurate payouts quickly and securely.

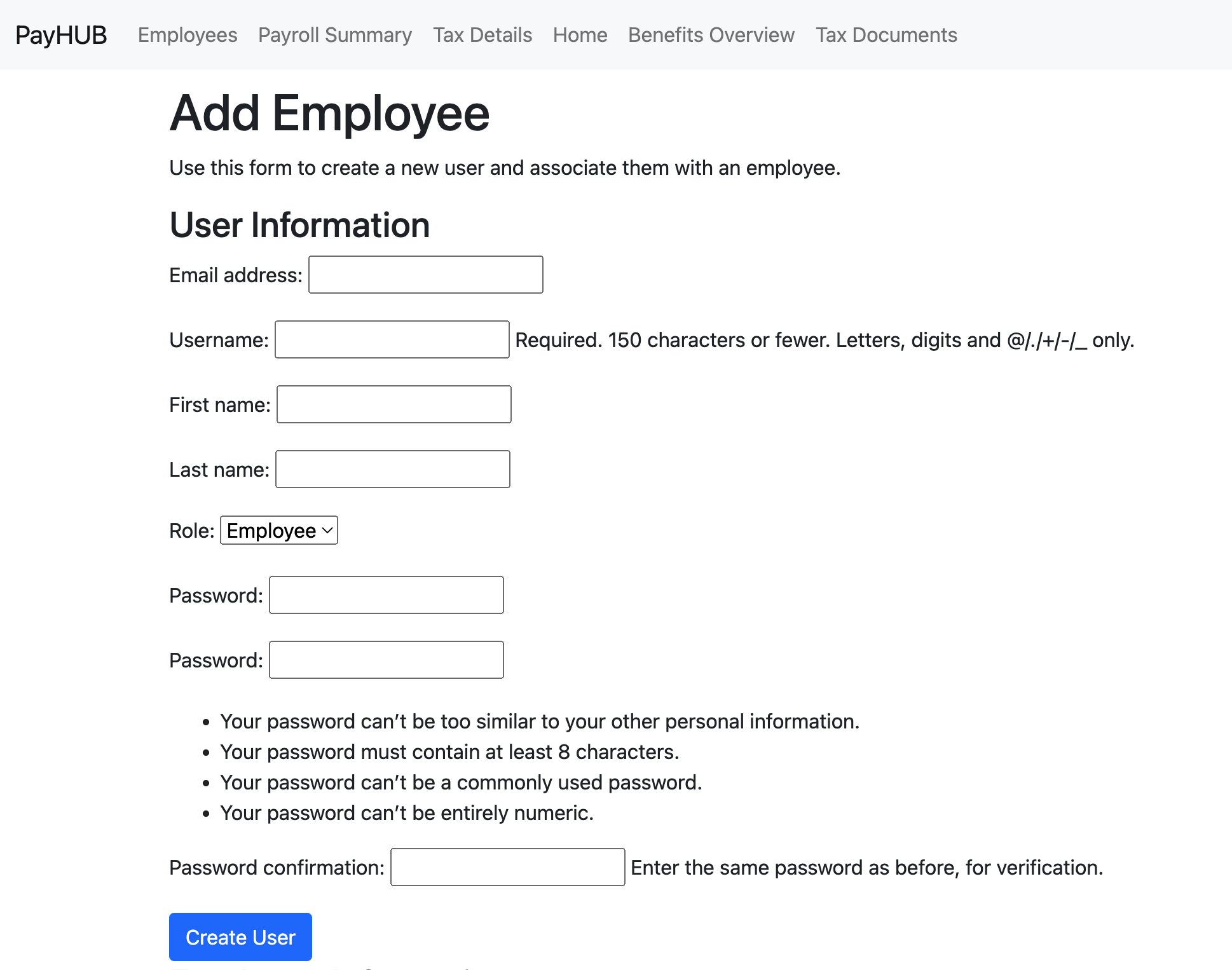

- Employee Management: View, add, and update employee records, including salaries, roles, and benefits.

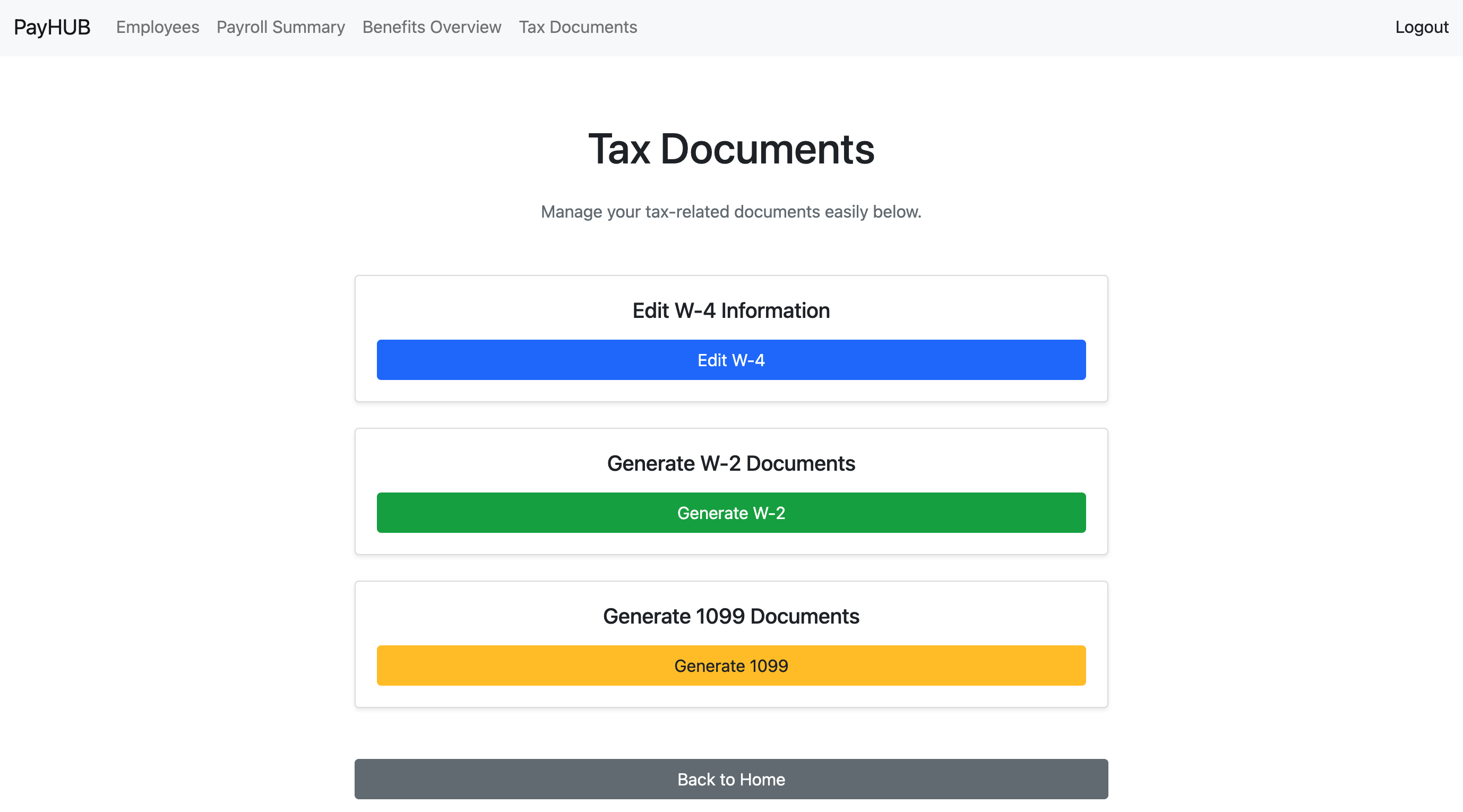

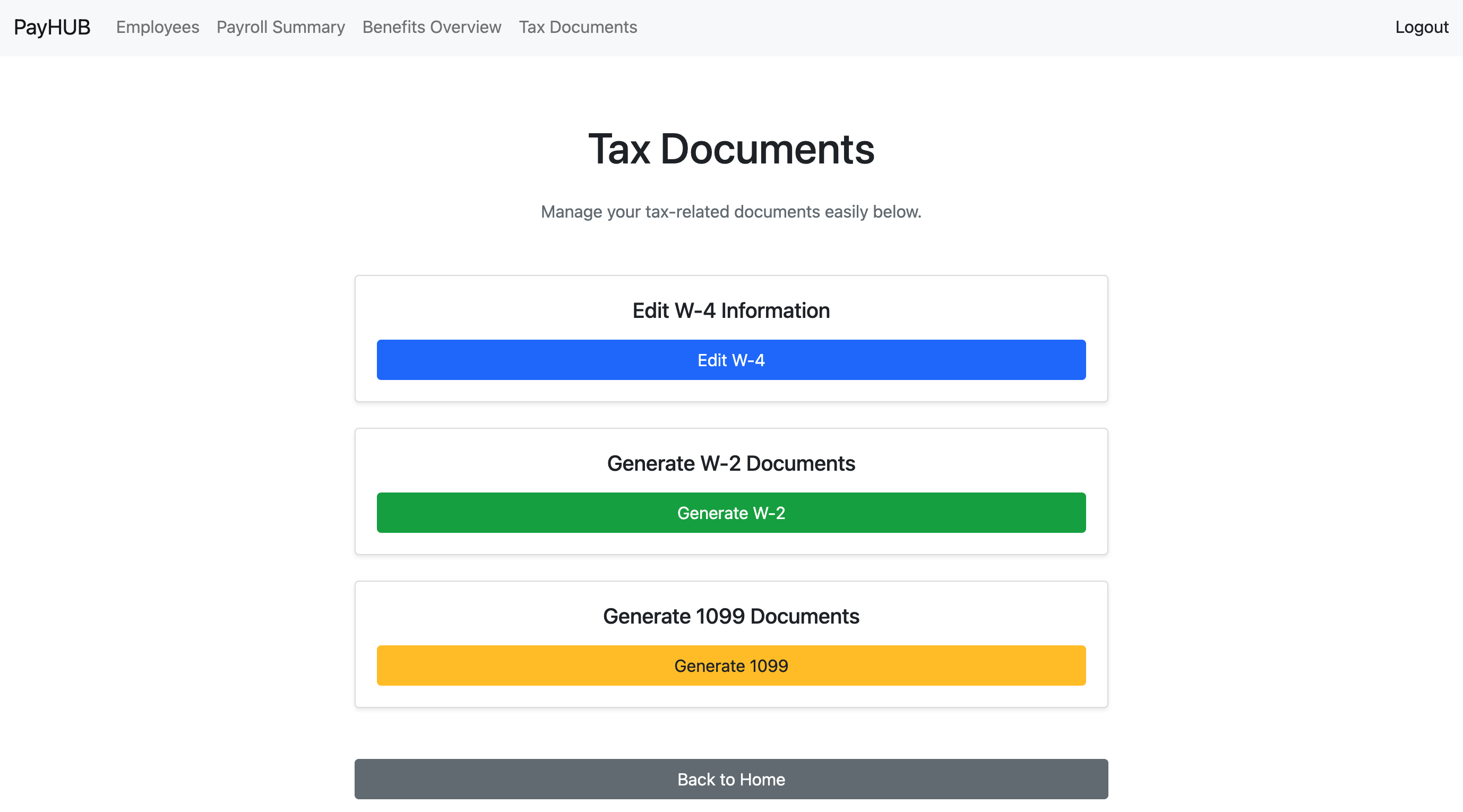

- Tax Overview: Automatically track tax deductions for all employees, simplifying compliance and reporting.

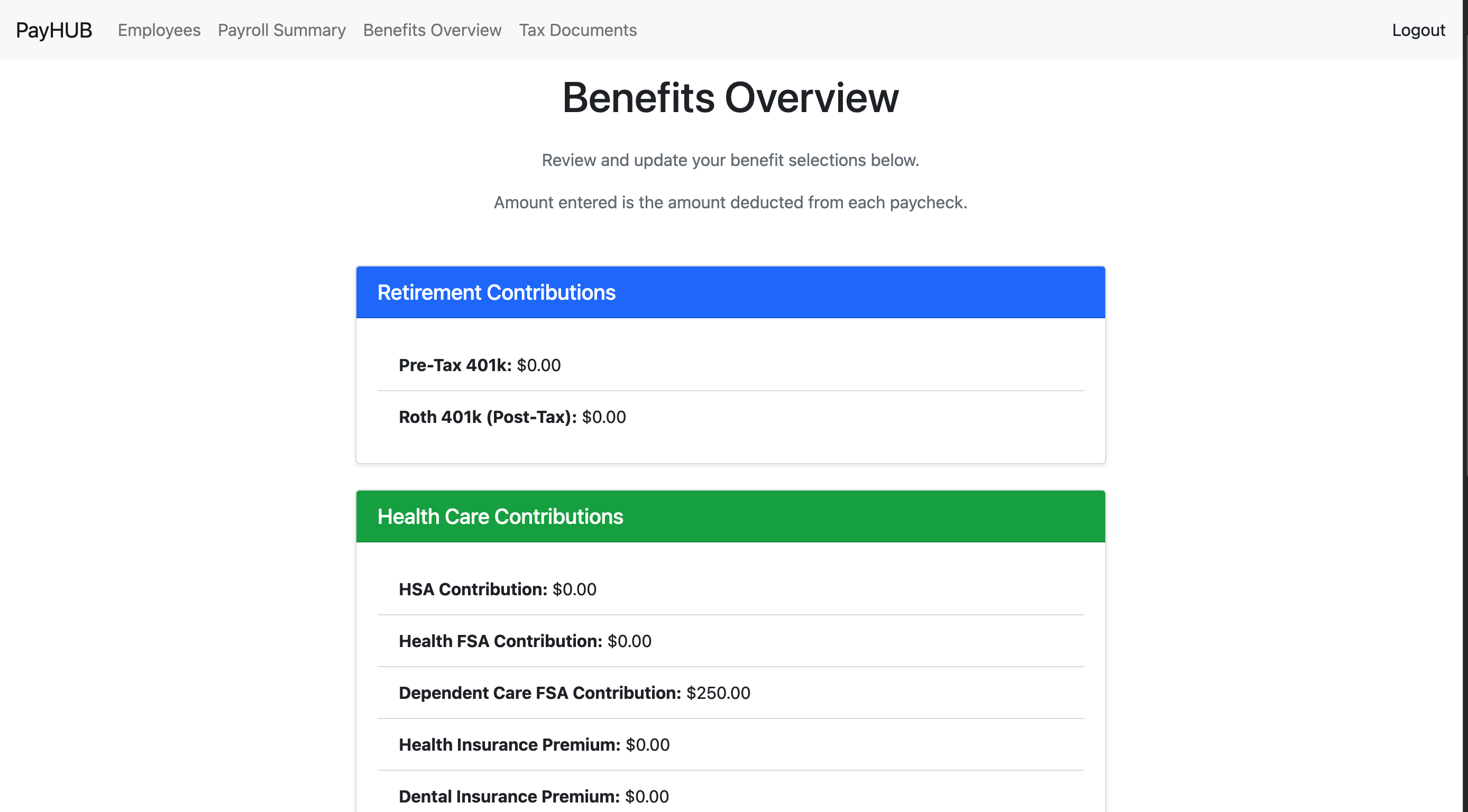

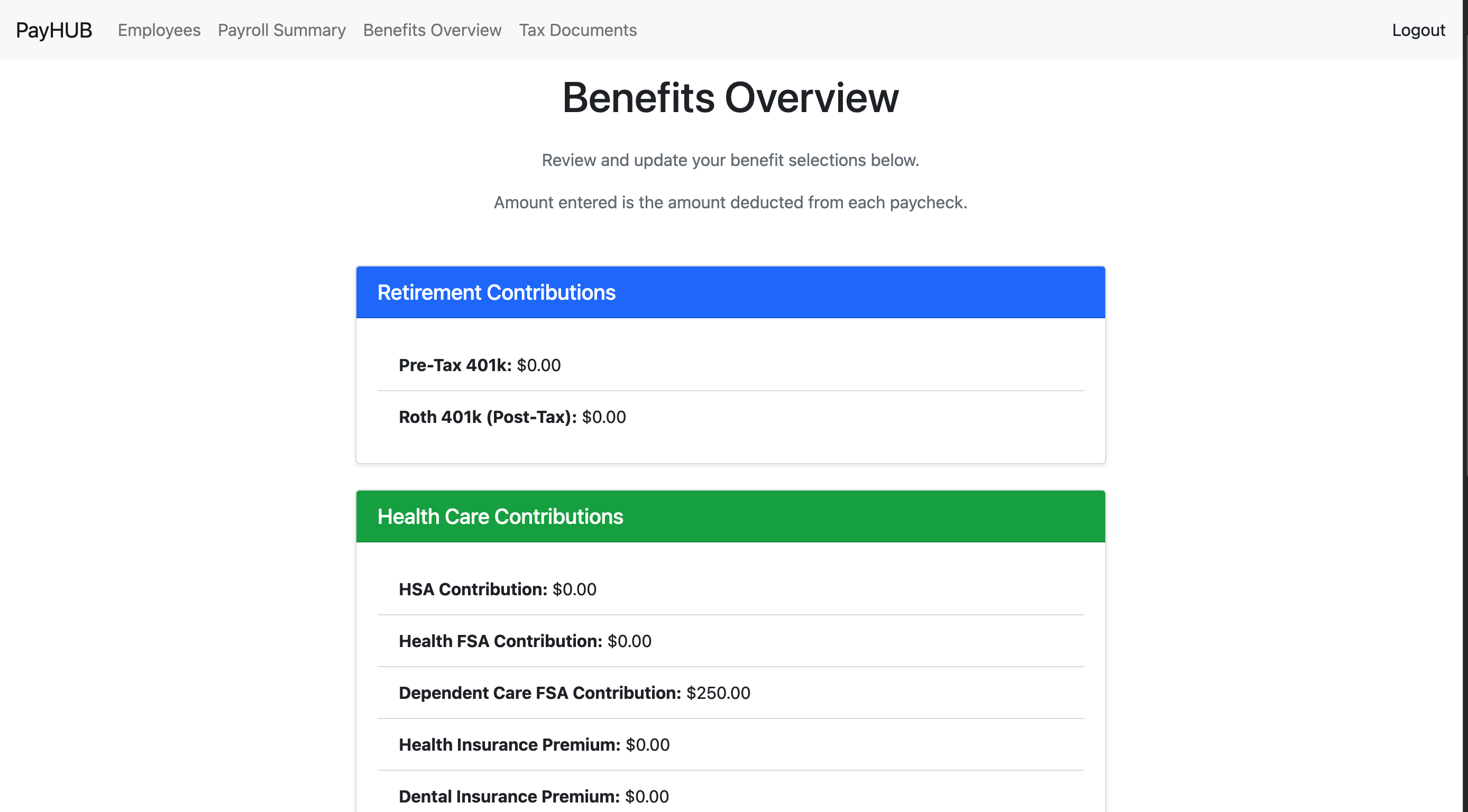

- Benefits Tracking: Monitor benefits provided to employees with integrated summaries.

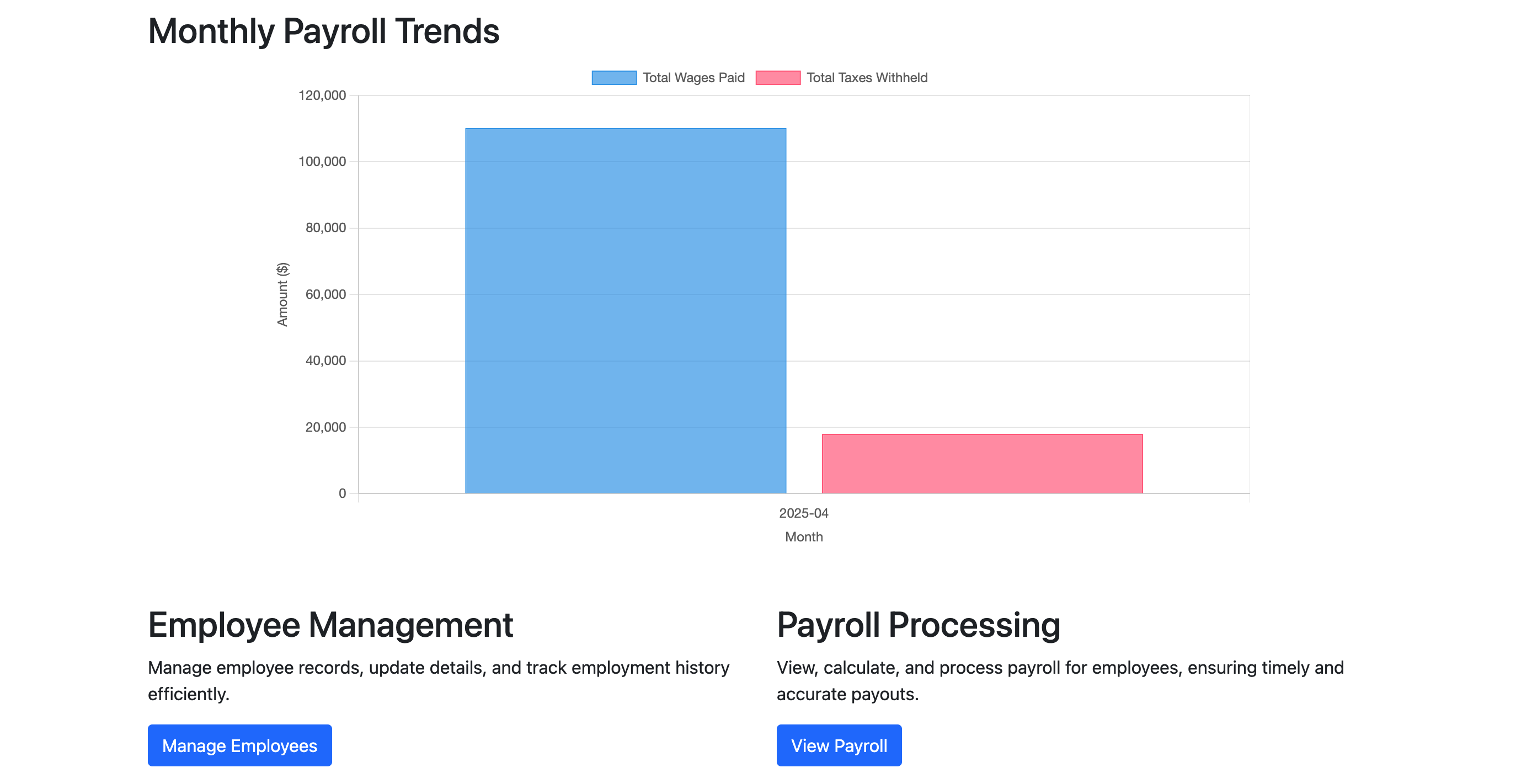

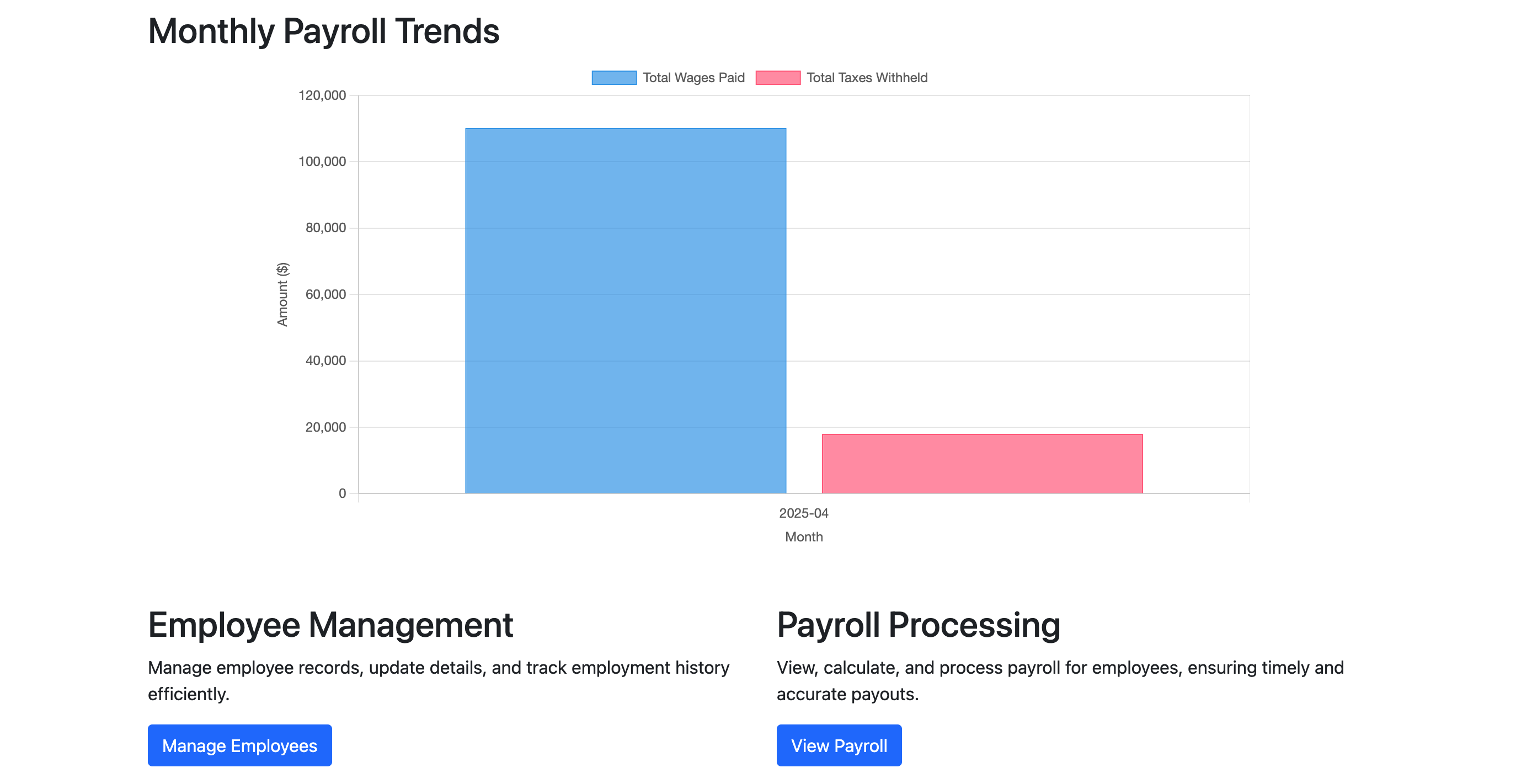

- Monthly Trends Dashboard: Visualize payroll data over time to identify patterns and plan ahead.

- Quick Start Panel: Perform key actions with one click: add new employees, income, or expenses.

- Secure Authentication: OAuth with JWT ensures data is protected and only accessible to authorized users.

How to Use PayHUB

PayHUB makes payroll and expense management simple. Follow these steps to get started:

- Log In: Sign in securely using OAuth-based authentication.

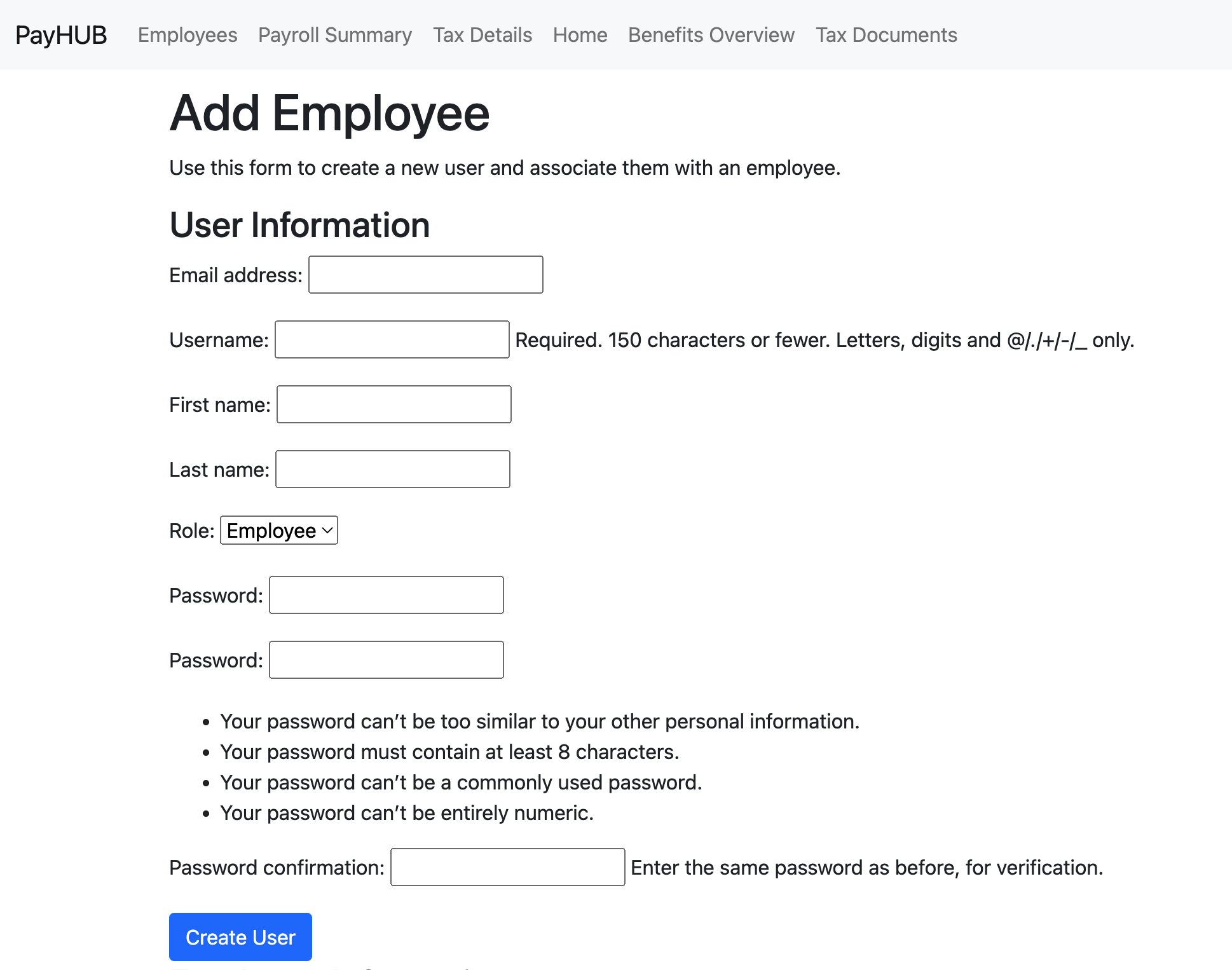

- Add Employees: Navigate to the Add Employee page to input employee details like name, salary, and hire date.

- Record Income and Expenses: Use the Add Income and Add Expense tools to track your business's finances.

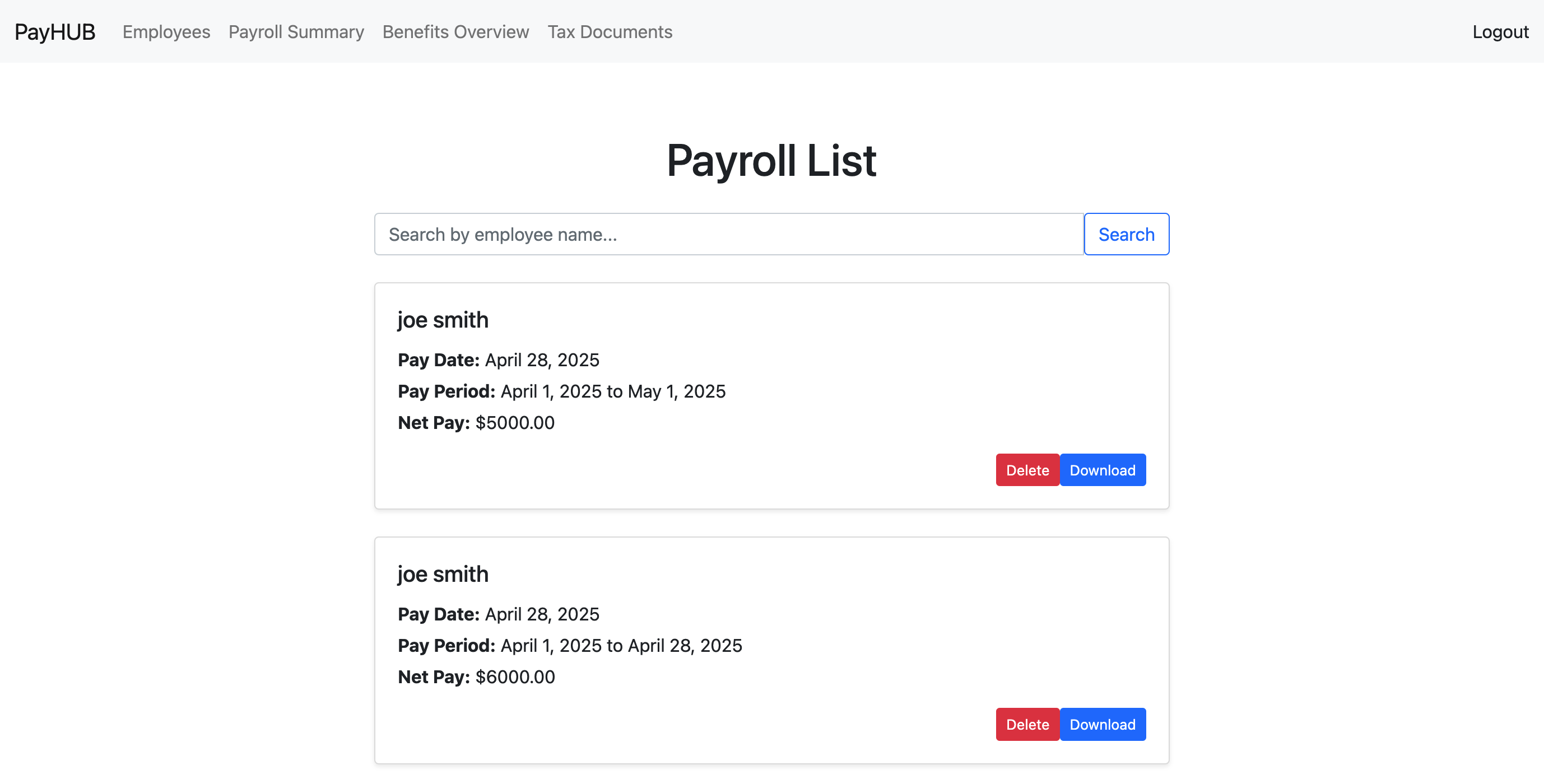

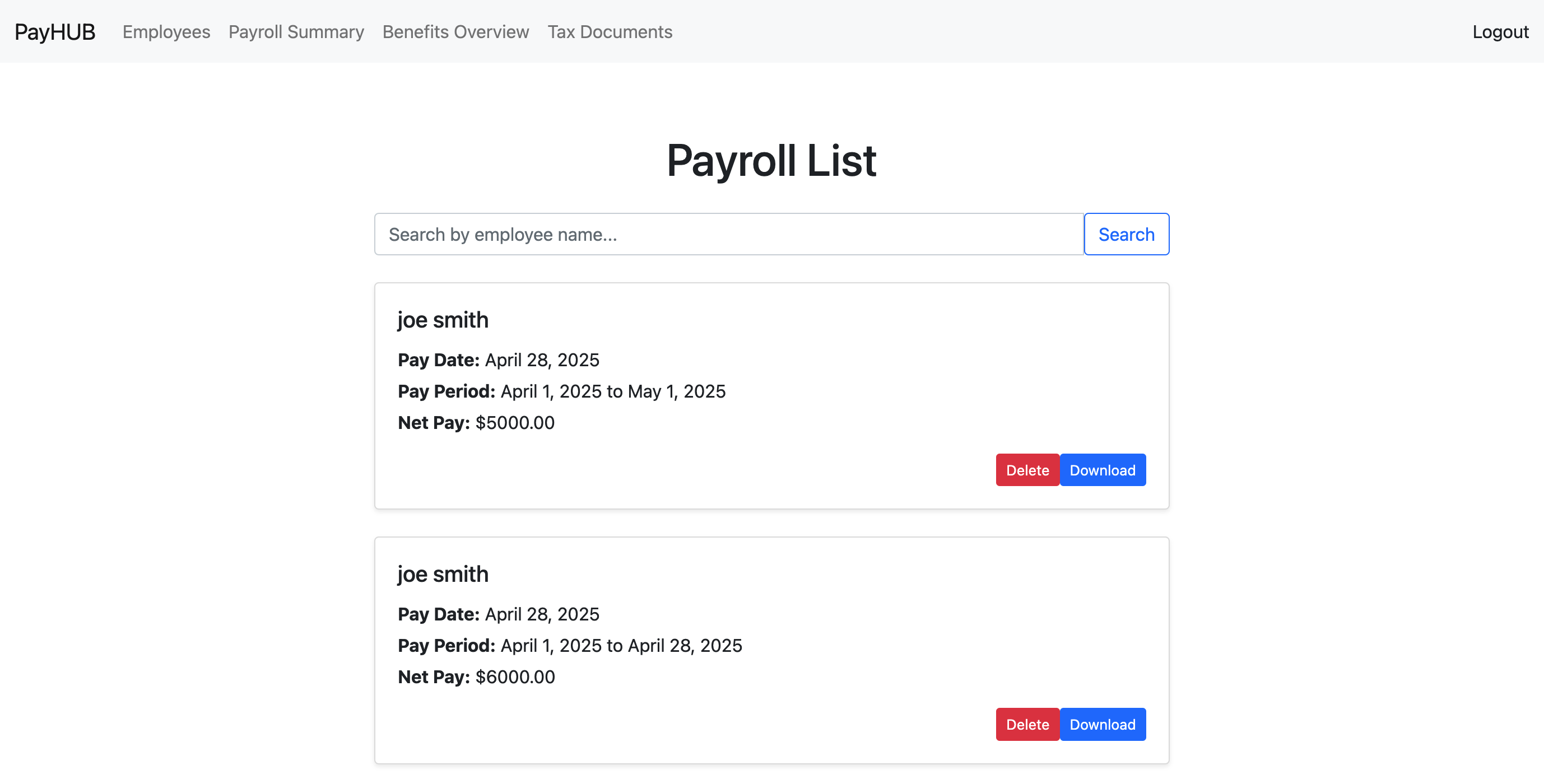

- Process Payroll: Head to Payroll Processing to calculate and generate payments based on hours worked, taxes, and deductions.

- View Reports: Access payroll summaries, tax details, and benefit overviews from the dashboard to stay on top of your financial health.

- Download Documents: Export payroll and tax reports as PDFs.

Note: The hyperlinks will work correctly if you are currently logged into PayHUB.

Screenshots

×

![Expanded screenshot]()